BTC is an asset that has experienced dozens of cycles of growth and decline over 15 years. And if the demand for buying and selling has stabilized, the question of where to store bitcoins in 2025 has become more relevant than ever. Against the backdrop of increased attention to digital security and the rise of attacks on exchanges, choosing the right storage solution has become a key factor in preserving investments.

Diversity of Wallets: Where to Store Bitcoin

Digital storage is not a bank vault but a software-hardware solution that provides access to private keys. The types of wallets determine the level of security, accessibility, and control over the funds.

Hot Wallets

Active wallets are connected to the internet, ensuring high transaction speed but are less resistant to hacking. They are used for operational management and daily transactions:

- Online wallets – accessible through a browser, for example, Blockchain.com, Trust Wallet. They offer convenience but require two-factor authentication and regular backups.

- Mobile wallets – leaders include Mycelium and BlueWallet. They support NFC, QR codes, SegWit, and provide the ability to quickly buy or sell BTC without going to an exchange.

- Desktop wallets – Electrum, Exodus, Wasabi. Suitable for professional users. The advantage is the ability to store private keys locally.

This storage format is suitable for active asset management and constant network access. However, each connection increases vulnerability, requiring strict control over security settings.

Cold Wallets

Offline storage completely isolates keys from network access, reducing the likelihood of compromise to almost zero. They are used for long-term storage of Bitcoin and large asset volumes.

Examples:

- Hardware wallets – Ledger Nano X, Trezor Model T, SafePal S1. These devices look like flash drives, are not susceptible to phishing, encrypt transactions at a physical level. Security at a military-grade level.

- Cold paper wallets – a physical sheet with printed keys. This method is outdated but still applicable in regions with limited internet access.

Isolated storage prevents access by intruders even in the event of a complete breach of online infrastructure. This approach keeps control in the hands of the owner and reduces dependence on external services.

Where to Store Bitcoin in 2025: Specific Services

Modern solutions combine convenience, security, and flexibility. Below is a list of relevant tools for various scenarios.

Top solutions for storing BTC:

- Ledger Nano X. A hardware wallet with Bluetooth and support for over 1800 assets. CC EAL5+ certification, autonomy up to 8 hours, built-in display.

- Trezor Model T. Touchscreen, PIN code, open-source firmware. Ideal for experienced users.

- Exodus Wallet. Multicurrency desktop interface, built-in exchange. Convenient for those who prefer flexibility.

- BlueWallet. Specializes in Bitcoin, supports Lightning Network. Suitable for micropayments and quick access.

- Coldcard Mk4. Standalone transaction signer working with microSD. Maximum isolation.

- Wasabi Wallet. Supports CoinJoin for anonymity. A choice for those who value privacy when storing Bitcoin (BTC).

- Trust Wallet. Mobile access, biometrics, in-app exchange. Suitable for quick use and basic operations.

Each of these solutions caters to different needs – from deep isolation to instant connection. Choosing the right option depends directly on storage goals, asset volume, and transaction frequency.

Security: the Main Currency of the 21st Century

Any reliable Bitcoin wallet must exclude access by third parties. Private keys are the only way to prove ownership. Leakage equals loss. Examples of exchange hacks (Mt. Gox – 850,000 BTC, Bitfinex – 120,000 BTC) have cemented the rule: where to store bitcoins is not a matter of convenience but a strategy.

To enhance security, it is recommended to:

- Protect the device with a password and biometrics.

- Store backup seed phrases in an offline environment.

- Use multi-signature and multi-factor authentication.

Technical discipline and minimizing digital traces create a robust shield against unauthorized access. A reliable storage system does not tolerate compromises and requires thoughtful decisions at every stage.

Where to Store Bitcoin for Beginners

Novice users often choose mobile applications such as Trust Wallet and BlueWallet. They allow buying, selling, and sending BTC without encountering excessive terminology. However, as the asset amount grows, it is advisable to switch to a secure Bitcoin wallet with private key isolation.

Initial capital up to $200 USD can be conveniently placed in a mobile wallet. When exceeding this threshold, it is better to use a hardware solution, especially if the assets are stored for more than 3 months.

Choosing a Bitcoin Wallet in 2025: Criteria

The choice requires attention not only to functionality but also an understanding of current trends in digital security. A modern Bitcoin wallet in 2025 should meet the following requirements:

- Support for multi-assets;

- Compatibility with dApps and DeFi;

- Ability to recover seed phrases;

- Open-source code;

- Integration with hardware devices.

Combining hot and cold storage allows flexible responses to market volatility, reduces risks, accelerates transactions, and controls access.

Where to Store Bitcoin Wisely: Conclusions

In 2025, the market offers dozens of solutions, but there is no universal one. Only a combination of a hardware wallet and a mobile interface allows for efficient asset management and protection against theft, failure, or compromise. Therefore, where to store bitcoins is not a matter of preference but the result of a conscious choice based on figures, risks, and goals.

Arbitrage trading takes different forms, which differ in transaction structure, number of assets, execution speed and geography. To understand how to make money with cryptocurrency arbitrage, it is necessary to consider the following main types:

Arbitrage trading takes different forms, which differ in transaction structure, number of assets, execution speed and geography. To understand how to make money with cryptocurrency arbitrage, it is necessary to consider the following main types: Arbitrage doesn’t require market prediction. It’s speed, structure, calculation, and a willingness to make quick decisions. How to make money with cryptocurrency arbitrage? As long as there are dozens of exchanges, coins, pairs, tokens, and valuation methods, there will be opportunities to profit from discrepancies. Either way, only those who understand the structure, assess the risks, track the costs, and test hypotheses can make a sustainable income from cryptocurrency arbitrage.

Arbitrage doesn’t require market prediction. It’s speed, structure, calculation, and a willingness to make quick decisions. How to make money with cryptocurrency arbitrage? As long as there are dozens of exchanges, coins, pairs, tokens, and valuation methods, there will be opportunities to profit from discrepancies. Either way, only those who understand the structure, assess the risks, track the costs, and test hypotheses can make a sustainable income from cryptocurrency arbitrage.

The sector is growing rapidly, but the top ten remains stable. Each service offers its own format: from full automation to manual analysis.

The sector is growing rapidly, but the top ten remains stable. Each service offers its own format: from full automation to manual analysis. Cryptocurrency arbitrage scanners are no longer the preserve of professionals. Accessibility of interfaces, availability of free versions, and support for mobile platforms have made arbitrage a real possibility, even for beginners. Automation, risk control, and lightning-fast analysis: all of this makes arbitrage a practice that is no longer a theory.

Cryptocurrency arbitrage scanners are no longer the preserve of professionals. Accessibility of interfaces, availability of free versions, and support for mobile platforms have made arbitrage a real possibility, even for beginners. Automation, risk control, and lightning-fast analysis: all of this makes arbitrage a practice that is no longer a theory.

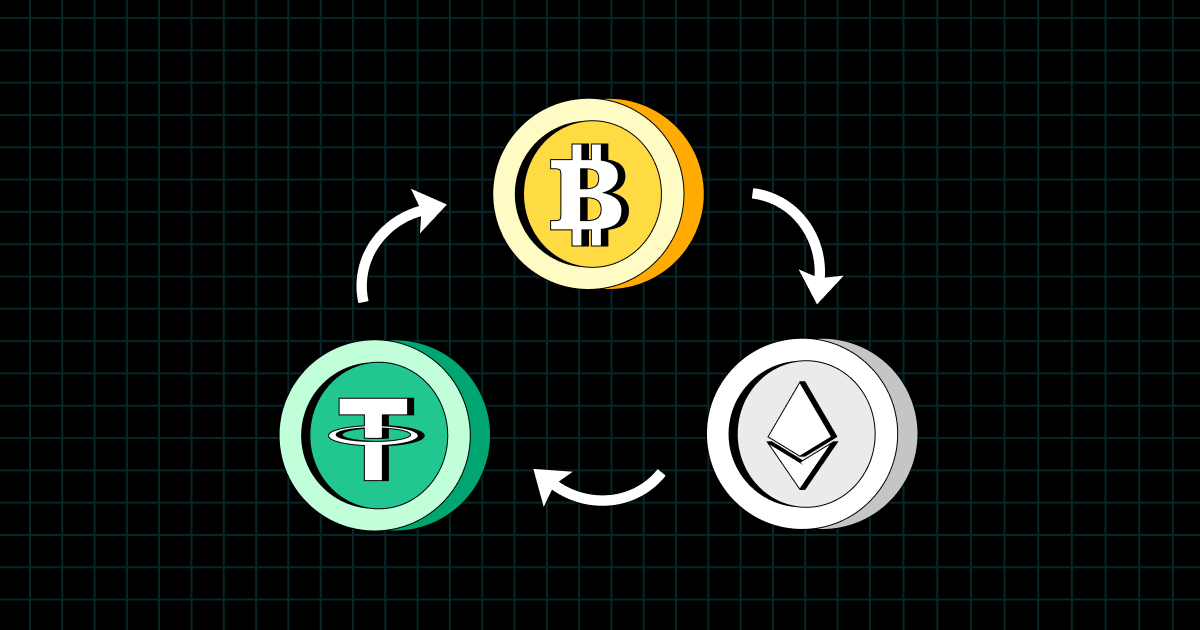

There are several popular forms of arbitrage. We will discuss each of them separately.

There are several popular forms of arbitrage. We will discuss each of them separately. The pros and cons of cryptocurrency arbitrage make this strategy a tool for those who want to constantly monitor the market and react quickly to changes. The potential profit depends on the speed of execution of the transaction, the size of the fees and the choice of suitable exchanges. Beginner traders should start with simple strategies and gradually increase their capital to be able to trade in this market.

The pros and cons of cryptocurrency arbitrage make this strategy a tool for those who want to constantly monitor the market and react quickly to changes. The potential profit depends on the speed of execution of the transaction, the size of the fees and the choice of suitable exchanges. Beginner traders should start with simple strategies and gradually increase their capital to be able to trade in this market.

Understanding how cryptocurrency arbitrage works is especially important for beginners who are just getting started in the world of cryptocurrency trading.

Understanding how cryptocurrency arbitrage works is especially important for beginners who are just getting started in the world of cryptocurrency trading.

How cryptocurrency arbitrage works is a question that concerns both novice and professional traders. The system offers the opportunity to profit from the exchange rate differences between exchanges by using technological solutions and fast action. Successful arbitrage requires in-depth knowledge of the market, as well as the ability to react quickly to changes and the ability to take into account costs and risks.

How cryptocurrency arbitrage works is a question that concerns both novice and professional traders. The system offers the opportunity to profit from the exchange rate differences between exchanges by using technological solutions and fast action. Successful arbitrage requires in-depth knowledge of the market, as well as the ability to react quickly to changes and the ability to take into account costs and risks.

The global economy has a significant impact on cryptocurrency arbitrage. Economic instability, inflation, and currency crises in various countries are forcing investors to seek reliable assets to protect their capital. Investment capital is increasingly turning to cryptocurrencies as a means of hedging against inflation and the devaluation of national currencies.

The global economy has a significant impact on cryptocurrency arbitrage. Economic instability, inflation, and currency crises in various countries are forcing investors to seek reliable assets to protect their capital. Investment capital is increasingly turning to cryptocurrencies as a means of hedging against inflation and the devaluation of national currencies. How to make money with cryptocurrency arbitrage? Technological advances and growing market opportunities have made it increasingly accessible and attractive to newcomers. Arbitrage offers a unique opportunity to profit from cryptocurrency price differences, but it requires in-depth knowledge, the right tools, and a strategic approach.

How to make money with cryptocurrency arbitrage? Technological advances and growing market opportunities have made it increasingly accessible and attractive to newcomers. Arbitrage offers a unique opportunity to profit from cryptocurrency price differences, but it requires in-depth knowledge, the right tools, and a strategic approach.

What is slippage in arbitrage? This is a situation where the expected price of a trade deviates from the actual price. Imagine you place an order to buy cryptocurrency at $500 per coin. By the time you execute the order, the price has already risen to $505. This “run” on the exchange rate is a drop that can wipe out your profits.

What is slippage in arbitrage? This is a situation where the expected price of a trade deviates from the actual price. Imagine you place an order to buy cryptocurrency at $500 per coin. By the time you execute the order, the price has already risen to $505. This “run” on the exchange rate is a drop that can wipe out your profits.

To successfully trade in cryptocurrency arbitrage, it is necessary to consider all risks and implement strategies to minimize them. Constantly analyze the market, choose the right exchanges, and use automation tools. This will not only protect your capital, but also provide stable profits.

To successfully trade in cryptocurrency arbitrage, it is necessary to consider all risks and implement strategies to minimize them. Constantly analyze the market, choose the right exchanges, and use automation tools. This will not only protect your capital, but also provide stable profits.

A more complex strategy that uses three different cryptocurrency pairs on one or more exchanges. It is important to react quickly to exchange rate changes, because the essence of this arbitrage is to close the trading cycle with a profit by taking advantage of exchange rate differences between currencies.

A more complex strategy that uses three different cryptocurrency pairs on one or more exchanges. It is important to react quickly to exchange rate changes, because the essence of this arbitrage is to close the trading cycle with a profit by taking advantage of exchange rate differences between currencies. Cryptocurrency arbitrage offers real profit opportunities, especially in the Russian market, where cryptocurrencies are not yet fully integrated into the financial system. Due to the unique situation associated with price differences on local and international exchanges, arbitrage has become an important tool for those who want to make money with cryptocurrencies.

Cryptocurrency arbitrage offers real profit opportunities, especially in the Russian market, where cryptocurrencies are not yet fully integrated into the financial system. Due to the unique situation associated with price differences on local and international exchanges, arbitrage has become an important tool for those who want to make money with cryptocurrencies.